What is an Index Fund?

There are over 20,000 investment products available today that come in all shapes and sizes. This is the first of several posts to help distinguish between the various product options.

An index fund is a type of mutual fund with a portfolio constructed to match or track the components of a market index, such as the Standard & Poor’s 500 Index (S&P 500). An index mutual fund is designed to provide broad market exposure, low operating expenses and low portfolio turnover.

“Indexing” is a passive form of fund management that has been successful in outperforming most actively managed mutual funds. While the most popular index funds track the S&P 500, a number of other indexes, including the Russell 2000 (small companies), the Wilshire 5000 (total stock market), the MSCI EAFE (foreign stocks in Europe, Australasia, Far East) and the Lehman Aggregate Bond Index (total bond market) are widely used for index funds.

The primary advantage in utilizing index funds is the lower management expense ratio. Also, a majority of mutual funds fail to beat broad indexes, such as the S&P 500.

The S&P 500® has been widely regarded as the best single gauge of the large cap U.S. equities market since the index was first published in 1957. But you couldn’t go out and buy the S&P 500. It wasn’t until the 70’s that the Vanguard 500 index fund was available for the individual investor. Since then, the experts have weighed in on the advantages and disadvantages to passive vs. active investment options. Understanding the difference between the two will help you make decisions around these varying options.

Special Guest – Peter Buffett

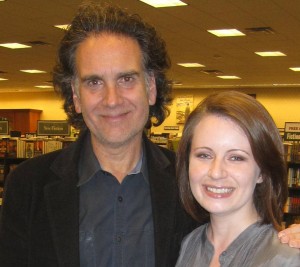

Alison Moss & Peter Buffett, son of billionaire investor Warren Buffett, team up for the official launch of Empowering Beneficiaries.

Alison Moss & Peter Buffett, son of billionaire investor Warren Buffett, team up for the official launch of Empowering Beneficiaries.

Click here PCP030311_PeterBuffett.mp3 (8.69 mb) to listen to a recording of their conference call.

Paul Comstock Partners (parent company to EB llc) has been educating clients about the markets, the economy, and investment research for almost 30 years. While we focus a great deal of our efforts on preserving wealth for our client families through investing, we find it equally important to prepare future generations who will one day manage the family wealth. We have long touted the importance of careful planning that allows future generations to be empowered by wealth. Empowering Beneficiaries, LLC takes our educational efforts to the next level!

Author of “Life is What You Make It,” Peter Buffett shares his story of how he chose to live his life, the decisions his parents made regarding wealth transfer, and why he wouldn’t have it any other way.

[rating:93/100]

Things to do before you say “I Do”

Recently a dear friend of mine became engaged. She and her fiancée carefully selected the venue, cake, flowers, menu, guest list, and endless other wedding details. As we chatted about their well-thought out plans, she asked what my husband and I did regarding our finances. Great question! How easy and fun it can be to only think about the wedding day. But what preparations are being made for life after the wedding? While planning personal finances are not nearly as exciting as choosing a bridal gown or wedding bands, they are important to consider during the process of joining two lives into one household.

Things to Consider When Combining His and Hers

Checking, savings, and investment accounts

Decide how you will pay bills, how much you want to save and what kind of investments you want to participate in. One suggestion that has worked for many couples is having multiple accounts that are linked together at an institution. The ability to keep things in separate “buckets” but combined at one institution can make it easier to stay organized and meet financial goals.

Retirement Savings

Most couples want to change the beneficiaries of their 401k/IRA to their spouse. A simple form is required to make that change. Also take a look at how each portfolio is allocated for diversification and take time to review how much each of you should be saving.

Insurance

o Life insurance – do you have enough coverage and who are the beneficiaries?

o Home/Renters insurance – do you have all your valuables covered, including your new diamonds?

o Auto – get on the same policy to save some money.

Debt

If you or your spouse have debt, find ways to pay it off as soon as possible. If one partner has considerably more debt than the other, now is the time to talk about how the debt will be paid and what each person’s expectations are for sacrifices to be made in order to pay that debt. You don’t want a few years to go by and find out later that the spouse without the debt is resenting the one who brought “red” into the family finances.

Power of attorney, wills, directives, etc.

No one wants to talk about death but it’s worth the discussion to protect yourself and your new spouse. After the honeymoon, start talking with an estate planning attorney and they will guide you through the process.

Considering a Prenuptial Agreement?

There are pros and cons to these pre-marriage contracts. Here are some questions to consider before you go down this path…

What are you and your family trying to protect?

What type of asset protection already exists (trusts, partnerships)?

Where are gaps that leave some assets exposed?

What kind of access to family funds does your family want you to have vs. your future spouse?

When deciding how to protect the family wealth everyone wants to be assured that the document or vehicle in place is going to work should problems arise down the road. While this topic deserves its own post, I will leave you with this thought. A prenup can be ripped up and therefore be meaningless. An irrevocable trust cannot. There are sophisticated planning tools that protect family assets that do not require relying exclusively on a prenup.

If you are G2 (3, 4, or 5) your parents are most likely behind the push for a prenup. Understandably so, as it is primarily your inheritance they want to protect. Get your own legal representation and collaborate with G1s legal council as issues of ownership and asset protection are sorted out. Hopefully the negative sentiments associate with prenups will be avoided with careful communication on the part of all family members.

[rating:98/100]

“6 Tips for Raising Cash Savvy Kids”

Over the years many parents have asked me how they can teach their kids to manage money. I’ve also had G2s come to me in desperation as they are now responsible for large sums of money and overwhelmed at the task before them. Think of how much better you would speak French if you learned it while you were young and had years to practice versus a crash course on the flight to Paris. Learning to make good financial decisions (big or small) works the same way. If we start teaching our children while they are young, allow them to practice and learn from experience, they will be much better prepared.

One of the most thorough, well thought out tools I’ve found to help parents teach young children healthy money habits is called FamZoo. While I don’t make it a habit to promote specific products, this one is worth touting. FamZoo was created by a G2 who wanted to be sure his kids learned healthy spending habits as he and his wife prepare them for inherited wealth. This virtual family bank guides parents, and kids, in taking small steps now that will prepare them for bigger financial responsibilities in the future.

If you are wondering how effective this kind of tool can be with your kids, read what the daughter of FamZoo founder, Bill Dwight, wrote on the company blog when asked about allowances:

On the How Much question, I particularly liked the advice: “the ideal allowance enables a child to buy some items but not others, thereby teaching selectivity and a basic form of budgeting.” (From Deciding On An Allowance at education.com) This goes for a child of any age. For example, my 8-year-old brother can either spend his money now on his favorite honey candy, or save for a few weeks to buy that set of Yu-Gi-Oh cards he’s been dying to have. Likewise, I can either spend money on a dinner with friends right now or save to buy those True Religion jean shorts I’ve been eyeing. Having a coveted item in mind makes saving worth passing up smaller opportunities along the way.

I think learning from your own spending mistakes is particularly important. I’ll never forget the time I blew half my clothing budget on a wear-it-once prom dress. I couldn’t afford any new clothing for the rest of the year – oopsie!

Well said, Haley! By providing boundaries (even when there’s plenty of money to buy it all), being consistent, and letting your kids learn from making their own mistakes, they will be better armed with the tools necessary to make bigger financial decisions down the road.

Check out the 6 Tips for Raising Cash Savvy Kids:

Still not sure if starting kids young is a good idea? Take a moment to read this article and learn how you can actually SAVE money by giving your kids an allowance. Sound crazy? It’s not. Learn more by reading: How to Save Money by Giving Your Child An Allowance

[rating:85/100]